Ohio Tax Abatement

H5 Data Centers' Cleveland Data Center is the First Multi-Tenant Data Center to Qualify for the State of Ohio's Tax Abatement Program.

In early 2014, the State of Ohio modified an existing statute to allow the sales tax exemption to extend to not only qualifying data center owners but also to customers of qualifying data center locations. H5 Data Centers and its customers have now qualified by investing more than $100 million and exceeding the employment and payroll requirements.

The Ohio Data Center Tax Abatement provides a sales-tax exemption rate and terms that allow for partial or full sales tax exemption on the purchase of eligible data center equipment. Projects must meet minimum investment and payroll thresholds to be available. Final approval of the tax exemption is contingent upon the approval of the Ohio Tax Credit Authority read more at JobsOhio.

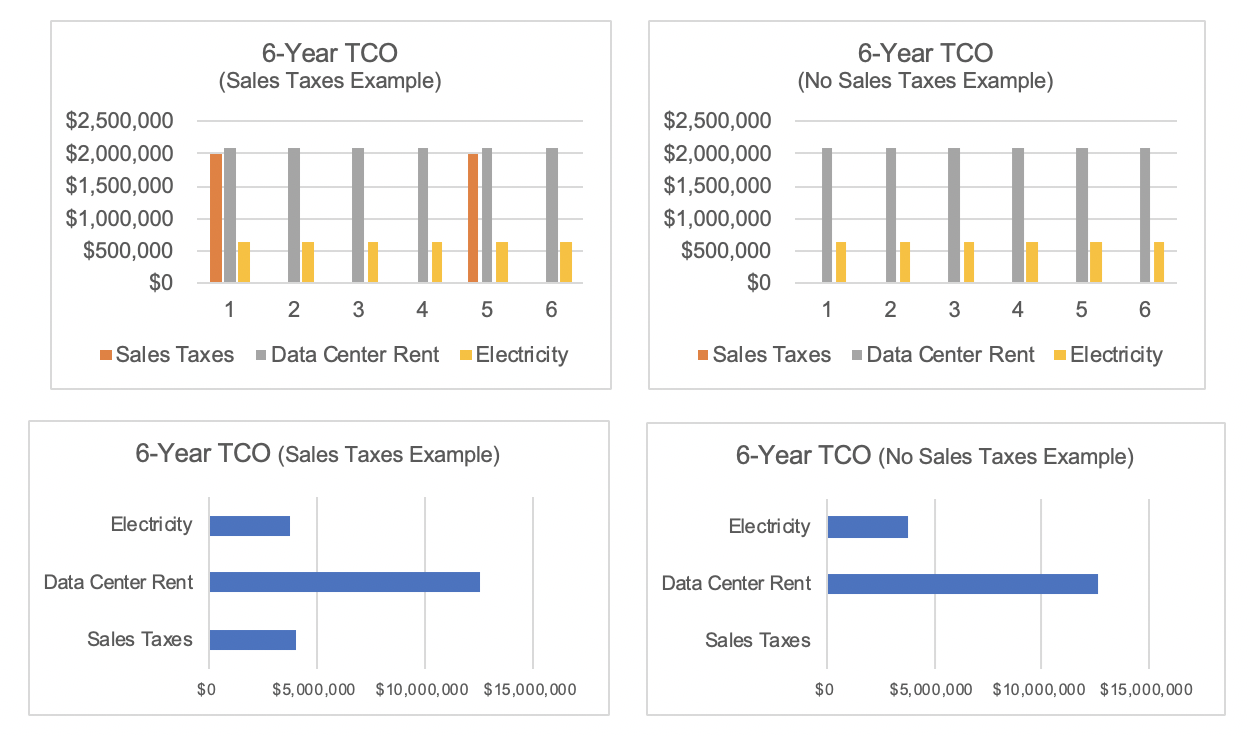

Unlike many of the data center tax-incentive bills enacted by other states, Ohio does not focus solely on big-name, single-tenant data center operators, such as Google, Facebook, Apple, or Amazon. These tax breaks were created to benefit both mega-scale single-tenant projects and companies that provide colocation services out of multi-tenant facilities, such as H5 Data Centers. Qualifying for sales tax exemption is a big benefit for medium to large data center users evaluating deployments in the mid-west or further east coast regions. Here are a few examples showing how a typical IT requirement in Cleveland can avoid paying sales taxes of approximately eight percent (8%), which can be the equivalent of several years of free rent.

Save Up to 25% on Data Center Infrastructure Deployments

H5 Cleveland Data Center Highlights:

- 351,000 square-foot data center

- Tier III data center design

- 100% sales tax abatement

- Annual SOC 2 Type II audits and ISO 27001 certification

Learn more about H5 Data Centers Cleveland